Perbankan Syariah | Malam ini admin akan memberikan informasi artikel mengenai Contoh Karya Ilmiah/Makalah tentang Pengertian, Skema, Contoh, dan Dasar Hukum Akad Mudharabah (Mudhorobah). Semoga Artikel ini, dapat bermanfaat untuk teman-teman semua guna menyelesaikan tugas yang diberikan oleh guru ataupun dosen.

A. Pengertian

Kata

mudharabah berasal dari kata dharb ( ضرب ) yang berarti memukul atau

berjalan. Pengertian memukul atau berjalan ini maksudnya adalah proses

seseorang memukulkan kakinya dalam menjalankan usaha. Suatu kontrak

disebut mudharabah, karena pekerja (mudharib) biasanya membutuhkan suatu

perjalanan untuk menjalankan bisnis. Sedangkan perjalanan dalam bahasa

Arab disebut juga dharb fil Ardhi (فِي الْأَرْض ضرب ِ).

Dalam

bahasa Iraq (penduduk Iraq) menamakannya mudharabah, sedangkan penduduk

Hijaz menyebutnya qiradh. Qiradh berasal dari kata al-qardhu, yang

berarti al-qath’u (potongan) karena pemilik memotong sebagian hartanya

untuk diperdagangkan dan memperoleh sebagian keuntungannya.

Mudharabah

atau qiradh termasuk dalam kategori syirkah. Di dalam Al-Quran, kata

mudharabah tidak disebutkan secara jelas dengan istilah mudharabah.

Al-Quran hanya menyebutkannya secara musytaq dari kata dharaba yang

terdapat sebanyak 58 kali. Beberapa ulama memberikan pengertian

mudharabah atau qiradh sebagai berikut:

a) Menurut

para fuqaha, mudharabah ialah akad antara dua pihak (orang) saling

menanggung, salah satu pihak menyerahkan hartanya kepada pihak lain

untuk diperdagangkan dengan bagian yang telah ditentukan dari

keuntungan, seperti setengah atau sepertiga dengan syarat-syarat yang

telah ditentukan.

b) Menurut Hanafiyah, mudharabah adalah “Akad syirkah dalam laba, satu pihak pemilik harta dan pihak lain pemilik jasa”.

c) Malikiyah

berpendapat bahwa mudharabah adalah: ”Akad perwakilan, di mana pemilik

harta mengeluarkan hartanya kepada yang lain untuk diperdagangkan dengan

pembayaran yang ditentukan (mas dan perak)”.

d) Imam

Hanabilah berpendapat bahwa Mudharabah adalah: ”Ibarat pemilik harta

menyerahakan hartanya dengan ukuran tertentu kepada orang yang berdagang

dengan bagian dari keuntungan yang diketahui”.

e) Ulama

Syafi’iyah berpendapat bahwa Mudharabah adalah: ” Akad yang menentukan

seseorang menyerahakan hartanya kepada orang lain untuk ditijarahkan”.

f) Syaikh

Syihab al-Din al-Qalyubi dan Umairah berpendapat bahwa mudharabah

ialah: “Seseorang menyerahkan harta kepada yang lain untuk ditijarhakan

dan keuntungan bersama-sama.”

g) Al-Bakri

Ibn al-Arif Billah al-Sayyid Muhammad Syata berpendapat bahwa

Mudharabah ialah: “Seseorang memberikan masalahnya kepada yang lain dan

di dalmnya diterima penggantian.”

h) Sayyid

Sabiq berpendapat, Mudharabah ialah “akad antara dua belah pihak untuk

salah satu pihak mengeluarkan sejumlah uang untuk diperdagangkan dengan

syarat keuntungan dibagi dua sesuai dengan perjanjian”.

i) Menurut Imam Taqiyuddin, mudharabah ialah ”Akad keuangan untuk dikelola dikerjakan dengan perdagangan.”

Dari

beberapa pengertian di atas dapat ditarik kesimpulan bahwa mudharabah

adalah akad kerjasama usaha antara dua pihak di mana pihak pertama

adalah pemilik modal (shahibul maal), sedangkan pihak lainnya menjadi

pengelola modal (mudharib), dengan syarat bahwa hasil keuntungan yang

diperoleh akan dibagi untuk kedua belah pihak sesuai dengan kesepakatan

bersama (nisbah yang telah disepakati), namun bila terjadi kerugian akan

ditanggung shahibul maal.

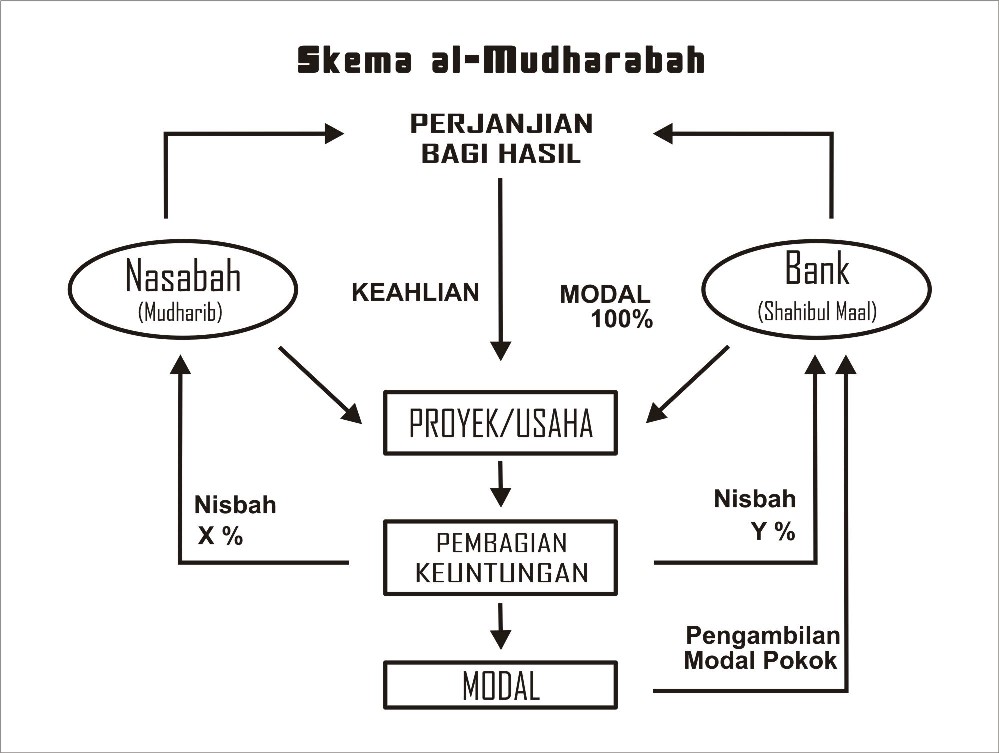

Skema Mudharabah

Modal 100%

Bagi Hasil + Modal

B. Dasar Hukum

• Dalil Qur’an

“Sesungguhnya

Tuhanmu mengetahui bahwasanya kamu berdiri (sembahyang) kurang dari dua

pertiga malam, atau seperdua malam atau sepertiganya dan (demikian

pula) segolongan dari orang-orang yang bersama kamu. dan Allah

menetapkan ukuran malam dan siang. Allah mengetahui bahwa kamu

sekali-kali tidak dapat menentukan batas-batas waktu-waktu itu, Maka Dia

memberi keringanan kepadamu, karena itu bacalah apa yang mudah (bagimu)

dari Al Quran. Dia mengetahui bahwa akan ada di antara kamu orang-orang

yang sakit dan orang-orang yang berjalan di muka bumi mencari sebagian

karunia Allah; dan orang-orang yang lain lagi berperang di jalan Allah,

Maka bacalah apa yang mudah (bagimu) dari Al Quran dan dirikanlah

sembahyang, tunaikanlah zakat dan berikanlah pinjaman kepada Allah

pinjaman yang baik. dan kebaikan apa saja yang kamu perbuat untuk dirimu

niscaya kamu memperoleh (balasan)nya di sisi Allah sebagai Balasan yang

paling baik dan yang paling besar pahalanya. dan mohonlah ampunan

kepada Allah; Sesungguhnya Allah Maha Pengampun lagi Maha Penyayang”.

(Al-Muzzammil [73]: 20)

Kata

yang menjadi wajhud-dilalah atau argument dari ayat di atas adalah

yadhribun yang sama dengan akar kata mudharabah yang berarti melakukan

suatu perjalanan usaha.

“Tidak

ada dosa bagimu untuk mencari karunia (rezki hasil perniagaan) dari

Tuhanmu. Maka apabila kamu telah bertolak dari 'Arafat (selesai wuquf),

berdzikirlah kepada Allah di Masy'aril Haram dan berdzikirlah (dengan

menyebut) Allah sebagaimana yang ditunjukkan-Nya kepadamu; dan

Sesungguhnya kamu sebelum itu benar-benar termasuk orang-orang yang

sesat”. [Al-Baqarah (2): 198]

• Dalil Hadist

كَانَ

سَيِّدُنَا الْعَبَّاسُ بْنُ عَبْدِ الْمُطَلِّبِ إِذَا دَفَعَ الْمَالَ

مُضَارَبَة اِشْتَرَطَ عَلَى صَاحِبِهِ أَنْ لاَ يَسْلُكَ بِهِ بَحْرًا،

وَلاَ يَنْزِلَ بِهِ وَادِيًا، وَلاَ يَشْتَرِيَ بِهِ دَابَّةً ذَاتَ

كَبِدٍ رَطْبَةٍ، فَإِنْ فَعَلَ ذَلِكَ ضَمِنَ، فَبَلَغَ شَرْطُهُ رَسُوْلَ

اللهِ صَلَّى اللهُ عَلَيْهِ وَآلِهِ وَسَلَّمَ فَأَجَازَهُ (رواه

الطبراني فى الأوسط عن ابن عباس).

”Adalah

Abbas bin Abdul Muththalib, apabila ia menyerahkan sejumlah harta dalam

investasi mudharabah, maka ia membuat syarat kepada mudharib, agar

harta itu tidak dibawa melewati lautan, tidak menuruni lembah dan tidak

dibelikan kepada binatang, Jika mudharib melanggar syarat2 tersebut,

maka ia bertanggung jawab menanggung risiko. Syarat-syarat yang diajukan

Abbas tersebut sampai kepada Rasulullah Saw, lalu Rasul

membenarkannya”.(HR ath_Thabrani). Hadist ini menjelaskan praktek

mudharabah muqayyadah.

ثلاثة فيهن البركة : المقارضة والبيع الى اجل وخلط البر باالشعير للبيت لا للبيع(ابن ماجه)

“Tiga

macam mendapat barakah: muqaradhah/ mudharabah, jual beli secara

tangguh, mencampur gandum dengan tepung untuk keperluan rumah bukan

untuk dijual”. (HR.Ibnu Majah).

عن

عبد الله و عبيد الله ابني عمر أنهما لقيا أبو موسى ألأشعري باالبصرة

منصرفهما من غزوة نهاوند فتسلفا منه مالا وابتاعا منه متاعا و قدما به

المدينة فباعاه و ربحا فيه و أراد عمر أخذ رأس المال الربح كله فقالا

لو كان تلف كان ضمنه علينا فكيف لا يكون الربح لنا فقال رجل يا أمير

المؤمنين لو جعلته قراضا فقال قد جعلته قراضا وأخذ منهما نصف الربح

(أخرجه مالك )

Dari

Abdullah dan ‘Ubaidullah, keduanya anak Umar, bahwa keduanya bertemu

dengan Abu Musa Al-Asy’ary di Basrah, setelah pulang dari perang

Nahawand. Keduanya menerima harta dari Abu Musa untuk dibawa ke Madinah

(ibu kota). Di perjalanan keduanya membeli harta benda perhiasan, lalu

menjualnya di Madinah, sehingga keduanya mendapat keuntungan. Umar

memutuskan untuk mengambil modal dan keuntungan semuanya. Tetapi kedua

anaknya berkata,”Jika harta itu binasa, bukankah kami yang bertanggung

jawab menggantinya. Bagaimana mungkin tak ada keuntungan untuk kami?”.

Maka berkata seseorang kepada Umar,“Wahai Amirul Mukminin, alangkah

baiknya jika engkau jadikan harta itu sebagai qiradh”. Umar pun menerima

usulan itu. Umar berkata,”Aku menjadikannya qiradh”. Umar mengambil

separoh dari keuntungan (50 % untuk Baitul Mal dan 50% untuk kedua

anaknya).

Mudharabah

menurut Ibn Hajar telah ada sejak zaman Rasulullah, beliau mengetahui

dan mengakuinya. Bahkan sebelum diangkat menjadi Rasul, Muhammad telah

melakukan Qiradh/ mudharabah. Muhammad mengadakan perjalanan ke Syam

untuk menjual barang-barang milik Khadijah r.a yang kemudian menjadi

istri beliau.

Di

samping dalil Qur’an dan dalil Hadist di atas, para ulama juga

berlandaskan pada praktik mudharabah yang dilakukan sebagian sahabat,

sedangkan sahabat lain tidak membantahnya. Bahkan harta yang dilakukan

secara mudharabah itu di zaman mereka kebanyakan adalah harta anak

yatim. Oleh sebab itu berdasarkan dalil Qur’an, Hadist, dan praktik para

sahabat, para ulama fiqih menetapkan bahwa akad mudharabah apabila

telah memenuhi rukun dan syaratnya maka hukumnya adalah boleh.

Rukun dan syarat-syarat sah mudharabah adalah sebagai berikut:

1. Adanya

dua pelaku atau lebih, yaitu investor (pemilik modal) dan pengelola

(mudharib). Kedua belah pihak yang melakukan akad disyaratkan mampu

melakukan tasharruf atau cakap hukum, maka dibatalkan akad anak-anak

yang masih kecil, orang gila, dan orang-orang yang berada di bawah

pengampuan.

2. Modal atau harta pokok (mal), syarat-syaratnya yakni:

A. Berbentuk uang

Mayoritas

ulama berpendapat bahwa modal harus berupa uang dan tidak boleh barang.

Mudharabah dengan barang dapat menimbulkan kesamaran, karena barang

pada umumnya bersifat fluktuatif. Apabila barang itu bersifat tidak

fluktuatif seperti berbentuk emas atau perak batangan (tabar), para

ulama berbeda pendapat. Imam malik dalam hal ini tidak tegas melarang

atau membolehkan. Namun para ulama mazhab Hanafi membolehkannya dan

nilai barang yang dijadikan setoran modal harus disepakati pada saat

akad oleh mudharib dan shahibul mal.

Contohnya,

seorang memiliki sebuah mobil yang akan diserahkan kepada mudharib

(pengelola modal). Ketika akad kerja sama tersebut disepakati, maka

mobal tersebut wajib ditentukan nilai mata uang saat itu, misalnya

Rp90.000.000, maka modal mudharabah tersebut adalah Rp90.000.000.

B. Jelas jumlah dan jenisnya

Jumlah

modal harus diketahui dengan jelas agar dapat dibedakan antara modal

yang diperdagangkan dengan laba atau keuntungan dari perdagangan

tersebut yang akan dibagikan kepada dua belah pihak sesuai dengan

perjanjian yang telah disepakati.

C. Tunai

Hutang

tidak dapat dijadikan modal mudharabah. Tanpa adanya setoran modal,

berarti shahibul mal tidak memberikan kontribusi apapun padahal mudharib

telah bekerja. Para ulama syafi’i dan Maliki melarang hal itu karena

merusak sahnya akad. Selain itu hal ini bisa membuka pintu perbuatan

riba, yaitu memberi tangguh kepada si berhutang yang belum mampu

membayar hutangnya dengan kompensasi si berpiutang mendapatkan imbalan

tertentu. Dalam hal ini para ulama fiqih tidak berbeda pendapat.

D. Modal diserahkan sepenuhnya kepada pengelola secara langsung

Apabila

tidak diserahkan kepada mudharib secara langsung dan tidak diserahkan

sepenuhnya (berangsur-angsur) dikhawatirkan akan terjadi kerusakan pada

modal, yaitu penundaan yang dapat mengganggu waktu mulai bekerja dan

akibat yang lebih jauh mengurangi kerjanya secara maksimal. Apabila

modal itu tetap dipegang sebagiannya oleh pemilik modal, dalam artian

tidak diserahkan sepenuhnya, maka menurut ulama Hanafiyah, Malikiyah,

dan Syafi’iyah, akad mudharabah tidak sah. Sedangkan ulama Hanabilah

menyatakan boleh saja sebagian modal itu berada di tangan pemilik modal,

asal tidak mengganggu kelancaran usahanya.

3. Keuntungan, syarat-syaratnya yakni:

A.

Proporsi jelas. Keuntungan yang akan menjadi milik pengelola dan

pemilik modal harus jelas persentasenya, seperti 60% : 40%, 50% : 50%

dan sebagainya menurut kesepakatan bersama.

B. Keuntungan harus dibagi untuk kedua belah pihak, yaitu investor (pemilik modal) dan pengelola (mudharib).

C.

Break Even Point (BEP) harus jelas, karena BEP menggunakan sistem

revenue sharing dengan profit sharing berbeda. Revenue sharing adalah

pembagian keuntungan yang dilakukan sebelum dipotong biaya operasional,

sehingga bagi hasil dihitung dari keuntungan kotor/ pendapatan.

Sedangkan profit sharing adalah pembagian keuntungan dilakukan setelah

dipotong biaya operasional, sehingga bagi hasil dihitung dari keuntungan

bersih.

4. Ijab

Qobul. Melafazkan ijab dari pemilik modal, misalnya aku serahkan uang

ini kepadamu untuk dagang jika ada keuntungan akan dibagi dua dan kabul

dari pengelola.

Dilihat dari transaksi (akad) yang dilakukan oleh shahibul mal dan mudharib, mudharabah terbagi menjadi :

a) Mudharabah

Muqayyadah ( Restricted Investment Account ), yaitu bentuk kerja sama

antara dengan syarat-syarat dan batasan tertentu. Dimana shahibul mal

membatasi jenis usaha, waktu atau tempat usaha. Dalam istilah ekonomi

Islam modern, jenis mudharabah ini disebut Restricted Investment

Account. Batasan-batasan tersebut dimaksudkan untuk menyelamatkan

modalnya dari resiko kerugian. Syarat-syarat itu harus dipenuhi oleh si

mudharib. Apabila mudharib melanggar batasan-batasan ini, maka ia harus

bertanggung jawab atas kerugian yang timbul.

Pembatasan

pada jenis mudharabah ini diperselisihkan para ulama mengenai

keabsahannya. Namun yang rajih, pembatasan tersebut berguna dan sama

sekali tidak menyelisihi dalil syar'i, karena hanya sekedar ijtihad dan

dilakukan berdasarkan kesepakatan dan keridhaan kedua belah pihak,

sehingga wajib ditunaikan. Cara pencatatan mudharabah muqayyadah ada dua

macam, yakni:

a. Off Balance Sheet, ketentuan-ketentuannya yaitu:

1. Bank Syari’ah bertindak sebagai arranger saja dan mendapat fee sbg arranger

2. Pencatatan transaksi di bank syari’ah secara off balance sheet

3. Bagi hasilnya hanya melibatkan nasabah investor dan debitur saja

4. Besar bagi hasil sesuai kesepakatan nasabah investor dan debitur

b. On Balance Sheet, ketentuan-ketentuannya yaitu:

1. Nasabah

Investor mensyarakatkan sasaran pembiayaan dananya, seperti untuk

pertanian tertentu, properti, atau pertambangan saja

2. Pencacatan di bank Syari’ah secara on balance sheet

3. Penentuan nisbah bagi hasil atas kesepakatan bank dan nasabah

b) Mudharabah

Muthlaqah ( Unrestricted Investment account ), yaitu bentuk kerja sama

antara shahibul mal dan mudharib tanpa syarat atau tanpa dibatasi oleh

spesifikasi jenis usaha, waktu, dan daerah bisnis. Dalam bahasa Inggris,

para ahli ekonomi Islam sering menyebut mudharabah muthlaqah sebagai

Unrestricted Investment Account (URIA). Maka apabila terjadi kerugian

dalam bisnis tersebut, mudharib tidak menanggung resiko atas kerugian.

Kerugian sepenuhnya ditanggulangi shahibul mal.

c) Mudharabah Musytarakah, adalah bentuk mudharabah dimana pengelola dana menyertakan modal atau dananya dalam kerjasama investasi.

E. Fatwa DSN

• Fatwa Dewan Syari’ah Nasional No. 07/DSN-MUI/ IV/ 2000 Tentang Pembiayaan Mudharabah (Qiradh)

Ketentuan Pembiayaan:

1) Pembiayaan Mudharabah adalah pembiayaan yang disalurkan oleh LKS kepada pihak lain untuk suatu usaha yang produktif.

2) Dalam

pembiayaan ini LKS sebagai shahibul maal (pemilik dana) membiayai 100 %

kebutuhan suatu proyek (usaha), sedangkan pengusaha (nasabah) bertindak

sebagai mudharib atau pengelola usaha.

3) Jangka

waktu usaha, tatacara pengembalian dana, dan pembagian keuntungan

ditentukan berdasarkan kesepakatan kedua belah pihak (LKS dengan

pengusaha).

4) Mudharib

boleh melakukan berbagai macam usaha yang telah disepakati bersama dan

sesuai dengan syari’ah; dan LKS tidak ikut serta dalam managemen

perusahaan atau proyek tetapi mempunyai hak untuk melakukan pembinaan

dan pengawasan.

5) Jumlah dana pembiayaan harus dinyatakan dengan jelas dalam bentuk tunai dan bukan piutang.

6) LKS

sebagai penyedia dana menanggung semua kerugian akibat dari mudharabah

kecuali jika mudharib (nasabah) melakukan kesalahan yang disengaja,

lalai, atau menyalahi perjanjian.

7) Pada

prinsipnya, dalam pembiayaan mudharabah tidak ada jaminan, namun agar

mudharib tidak melakukan penyimpangan, LKS dapat meminta jaminan dari

mudharib atau pihak ketiga. Jaminan ini hanya dapat dicairkan apabila

mudharib terbukti melakukan pelanggaran terhadap hal-hal yang telah

disepakati bersama dalam akad.

8) Kriteria pengusaha, prosedur pembiayaan, dan mekanisme pembagian keuntungan diatur oleh LKS dengan memperhatikan fatwa DSN.

9) Biaya operasional dibebankan kepada mudharib.

10) Dalam

hal penyandang dana (LKS) tidak melakukan kewajiban atau melakukan

pelanggaran terhadap kesepakatan, mudharib berhak mendapat ganti rugi

atau biaya yang telah dikeluarkan.

Kedua : Rukun dan Syarat Pembiayaan:

1. Penyedia dana (sahibul maal) dan pengelola (mudharib) harus cakap hukum.

2. Pernyataan

ijab dan qabul harus dinyatakan oleh para pihak untuk menunjukkan

kehendak mereka dalam mengadakan kontrak (akad), dengan memperhatikan

hal-hal berikut:

a. Penawaran dan penerimaan harus secara eksplisit menunjukkan tujuan kontrak (akad).

b. Penerimaan dari penawaran dilakukan pada saat kontrak.

c. Akad dituangkan secara tertulis, melalui korespondensi, atau dengan menggunakan cara-cara komunikasi modern.

3. Modal

ialah sejumlah uang dan/atau aset yang diberikan oleh penyedia dana

kepada mudharib untuk tujuan usaha dengan syarat sebagai berikut:

a. Modal harus diketahui jumlah dan jenisnya.

b.

Modal dapat berbentuk uang atau barang yang dinilai. Jika modal

diberikan dalam bentuk aset, maka aset tersebut harus dinilai pada waktu

akad.

c. Modal tidak

dapat berbentuk piutang dan harus dibayarkan kepada mudharib, baik

secara bertahap maupun tidak, sesuai dengan kesepakatan dalam akad.

4. Keuntungan mudharabah adalah jumlah yang didapat sebagai kelebihan dari modal. Syarat keuntungan berikut ini harus dipenuhi:

a. Harus diperuntukkan bagi kedua pihak dan tidak boleh disyaratkan hanya untuk satu pihak.

b.

Bagian keuntungan proporsional bagi setiap pihak harus diketahui dan

dinyatakan pada waktu kontrak disepakati dan harus dalam bentuk

prosentasi (nisbah) dari keuntungan sesuai kesepakatan. Perubahan nisbah

harus berdasarkankesepakatan.

c.

Penyedia dana menanggung semua kerugian akibat dari mudharabah, dan

pengelola tidak boleh menanggung kerugian apapun kecuali diakibatkan

dari kesalahan disengaja, kelalaian, atau pelanggaran kesepakatan.

5. Kegiatan

usaha oleh pengelola (mudharib), sebagai perimbangan (muqabil) modal

yang disediakan oleh penyedia dana, harus memperhatikan hal-hal berikut:

a.

Kegiatan usaha adalah hak eksklusif mudharib, tanpa campur tangan

penyedia dana, tetapi ia mempunyai hak untuk melakukan pengawasan.

b.

Penyedia dana tidak boleh mempersempit tindakan pengelola sedemikian

rupa yang dapat menghalangi tercapainya tujuan mudharabah, yaitu

keuntungan.

c. Pengelola

tidak boleh menyalahi hukum Syari’ah Islam dalam tindakannya yang

berhubungan dengan mudharabah, dan harus mematuhi kebiasaan yang berlaku

dalam aktifitas itu.

Beberapa Ketentuan Hukum Pembiayaan:

1) Mudharabah boleh dibatasi pada periode tertentu.

2) Kontrak tidak boleh dikaitkan (mu’allaq) dengan sebuah kejadian di masa depan yang belum tentu terjadi.

3) Pada

dasarnya, dalam mudharabah tidak ada ganti rugi, karena pada dasarnya

akad ini bersifat amanah (yad al-amanah), kecuali akibat dari kesalahan

disengaja, kelalaian, atau pelanggaran kesepakatan.

4) Jika

salah satu pihak tidak menunaikan kewajibannya atau jika terjadi

perselisihan di antara kedua belah pihak, maka penyelesaiannya dilakukan

melalui Badan Arbitrasi Syari’ah setelah tidak tercapai kesepakatan

melalui musyawarah

• Fatwa Dewan Syariah Nasional No. 50/ DSN-MUI/ III/ 2006 Tentang Akad Mudharabah Musytarakah

Pertama : Ketentuan Umum

Mudharabah

Musytarakah adalah bentuk akad Mudharabah di mana pengelola (mudharib)

menyertakan modal atau dananya dalam kerjasama investasi.

Kedua : Ketentuan Hukum

Mudharabah Musytarakah boleh dilakukan oleh Lembaga Keuangan Syari’ah (LKS), karena merupakan bagian dari hukum Mudharabah.

Ketiga : Ketentuan Akad

1. Akad yang digunakan adalah akad Mudharabah Musytarakah, yaitu perpaduan dari akad Mudharabah dan akad Musyarakah.

2. LKS sebagai mudharib menyertakan modal atau dananya dalam investasi bersama nasabah.

3. LKS

sebagai pihak yang menyertakan dananya (musytarik) memperoleh bagian

keuntungan berdasarkan porsi modal atau yang disertakan.

4. Bagian

keuntungan sesudah diambil oleh LKS sebagai musytarik dibagi antara LKS

sebagai mudharib dengan nasabah dana sesuai dengan nisbah yang

disepakati.

5. Apabila terjadi kerugian maka LKS sebagai musytarik menanggung kerugian sesuai dengan porsi modal atau dana yang disertakan.

Keempat : Ketentuan Penutup

1. Jika

salah satu pihak tidak menunaikan kewajibannya atau jika terjadi

perselisihan di antara para pihak, maka penyelesaiannya dilakukan

melalui Badan Arbitrase Syari’ah setelah tidak tercapai kesepakatan

melalui musyawarah.

2. Fatwa

ini berlaku sejak tanggal ditetapkan, dengan ketentuan jika di kemudian

hari ternyata terdapat kekeliruan, akan diubah dan disempurnakan

sebagaimana mestinya.

F. Perbedaan Bunga dan Bagi Hasil

No Bunga Bagi Hasil

1. Penentuan bunga dibuat sebelum

nya (pada waktu akad) tanpa

berpedoman pada untung rugi Penentuan besarnya rasio bagi hasil dibuat pada waktu akad dgn berpedoman pada untung rugi

2. Besarnya persentase (bunga)

ditentukan sebelumnya berdasar

kan jumlah uang yang dipinjamkan Besarnya bagi hasil berdasarkan keuntungan, sesuai dgn rasio yang disepakati

3. Jumlah pembayaran bunga tidak meningkat sekalipun jumlah keuntungan meningkat Jumlah pembagian laba meningkat sesuai dengan peningkatan pendapatan

4. Jika terjadi kerugian, ditanggung si

Peminjam saja, berdasarkan pemba

yaran bunga tetap yang dijanjikan Jika terjadi kerugian ditanggung kedua belah pihak

5. Besarnya bunga yang harus dibayar si peminjam pasti diterima bank Keberhasilan usaha menjadi perhatian bersama

6. Umumnya Agama (terutama Islam) Mengecamnya Tidak ada yang Meragukan Sistem Bagi Hasil

7. Berlawanan dgn Surah Luqman : 34 Melaksanakan Surah Luqman : 34

G. Aplikasi Mudharabah di Bank Syariah

Mudharabah

biasanya diterapkan pada produk-produk pembiayaan dan pendanaan. Pada

sisi penghimpunan dana, al-mudharabah diterapkan pada :

a) Tabungan

mudharabah adalah simpanan pihak ketiga di Bank Syariah yang

penarikannnya dapat dilakukan setiap saat atau beberapa hari sesuai

perjanjian. Dalam hal ini Bank bertindak sebagai Mudharib ( pengelola

modal) dan deposan sebagai Shahibul Maal (pemilik modal). Bank sebagai

mudharib akan membagi keuntungan kepada shahibul Maal sesuai dengan

nisbah (persentase) yang telah disepakati bersama.

b) Deposito

Mudharabah ( Deposito Investasi Mudharabah) merupakan investasi melalui

simpanan pihak ketiga (perorangan atau badan hukum), yang penarikannnya

hanya dapat dilakukan dalam jangka waktu tertentu (jatuh tempo) dengan

mendapatkan imbalan bagi hasil.

Adapun dari sisi pembiayaan, mudharabah diterapkan untuk :

a) Pembiayaan

modal kerja. Bank menyediakan pembiayaan modal investasi atau modal

kerja sepenuhnya (pemilik modal/ sahhibul maal), sedangkan nasabah

menyediakan usaha dan manajemennya (mudharib) Hasil keuntungan akan

dibagi sesuai dengan kesepakatan bersama dalam bentuk nisbah

(persentase) tertentu dari keuntungan misalnya 65% : 35%.

b) Investasi

khusus, disebut juga mudharabah muqayyadah, di mana sumber dana khusus

dengan penyaluran dana yang khusus dengan syarat-syarat yang telah

ditetapkan oleh shahibul maal.

Mekanisme dan Sistem Operasi Mudharabah di Bank Syariah

Pendanaan Mudharabah Pembiayaan Mudharabah

Bank Syariah

Bagi Hasil Bagi Hasil

Dalam praktik perbankan syariah, kini dikenal dua bentuk mudharabah muqayyadah, yaitu:

a) On

balance sheet, yaitu aliran dana terjadi dari satu nasabah investor ke

sekelompok pelaksana usaha dalam beberapa sektor terbatas, misalnya

pertanian, manufaktur dan jasa. Nasabah investor lainnya mungkin

mensyaratkan dananya hanya boleh dipakai untuk pembiayaan di sektor

pertambangan, properti dan pertanian. Selain berdasarkan sektor, nasabah

investor dapat saja mensyaratkan berdasarkan jenis akad yang digunakan,

misalkan hanya berdasarkan akad penjualan kredit saja. Skema ini

disebut On balance Sheet karena dicatat dalam neraca Bank.

b) Off

balance sheet, yaitu aliran dana berasal dari satu nasabah investor

kepada satu nasabah pembiayaan (yang dalam bank konvensional disebut

debitur). Di sini bank syariah hanya bertindak sebagai arranger saja.

Pencatatan transaksinya di bank syariah dilakukan secara off balance

sheet. Bagi hasilnya hanya melibatkan nasabah investor dan pelaksana

usaha sesuai dengan kesepakatan mereka, sedangkan bank hanya memperoleh

arranger fee.

H. Jaminan (Collateral)

I. Jaminan mudharabah dalam litelatur fiqih

Hubungan

antara investor dengan mudharib adalah hubungan yang bersifat "gadai"

dan mudharib adalah orang yang dipercaya, maka tidak ada jaminan oleh

mudharib kepada investor. Investor tidak dapat menuntut jaminan apapun

dari mudharib untuk mengembalikan modal dengan keuntungan. Jika investor

mempersyaratkan pemberian jaminan dari mudharib dan menyatakan hal ini

dalam syarat kontrak, maka kontrak mudharabah mereka tidak sah, demikian

menurut Malik dan Syafi’i.

2. Jaminan mudharabah dalam perbankan syariah

Berdasarkan

fatwa DSN – MUI mengenai pembiayaan mudharabah (qiradh) bahwa pada

prinsipnya dalam mudharabah tidak ada jaminan. Namun agar mudharib tidak

melakukan penyimpangan, Lembaga Keuangan Syari’ah dapat meminta jaminan

dari mudharib atau pihak ketiga. Jaminan ini hanya dapat dicairkan

apabila mudharib terbukti melakukan pelanggaran terhadap hal-hal yang

telah disepekati bersama dalam akad. Jadi jaminan hanya untuk menunjukan

keseriusan dan mencegah mudharib melakukan penyelewengan. Seperti

pernyataan yang dikutip dari AAOIFI, Accounting and Auditing

Organization for Islamic Financial Institutions, Bahrain, 1998 bahwa

“Collateral is important to protect Islamic bank from any misconduct”.

J. Aplikasi Mudharabah di Lembaga Keuangan Syariah

• Asuransi Syariah

1. Takaful keluarga

Premi

takaful yang diterima dimasukkan ke dalam ”Rekening Tabungan” yaitu

rekening tabungan peserta dan ”Rekening Khusus (Tabarru’) yaitu rekening

yang khusus disediakan untuk kebaikan berupa pembayaran klaim (manfaat

takaful) kepada ahli waris jika di antara peserta ada yang meninggal

dunia atau mengalami musibah lainnya. Premi takaful tersebut disatukan

dalam kumpulan dana peserta, kemudian dikembangkan melalui investasi

proyek yang dibenarkan Islam, dengan menerapkan prinsip al-mudharabah

sesuai dengan kesepakatan misalnya 70 % keuntungan untuk peserta dan 30 %

untuk perusahaan. Dari keuntungan peserta yang 70 % itu dimasukkan

dalam rekening tabungan dan rekening khusus secara proporsional.

Sedangkan keuntungan perusahaan sebesar 30 % dipergunakan untuk

pembiayaan operasional perusahaan.

– Realisasi pembayaran rekening dilakukan jika :

• masa pertanggungan berakhir

• peserta mengundurkan diri dalam masa pertanggungan.

• Peserta meninggal dunia dalam masa pertanggungan.

- Sedangkan pembayaran rekening dilakukan jika :

• peserta meninggal dunia dalam masa peratanggungan

• masa pertanggungan berakhir (jika ada).

2. Takaful umum

Premi

Takaful yang diterima dimasukkan kedalam rekening khusus (tabarru’)

yaitu rekening yang khusus disediakan untuk kebaikan berupa pembayaran

klaim kepada peserta jika sewaktu-waktu tertimpa musibah baik terhadap

harta maupun diri peserta. Premi Takaful tersebut dimasukkan ke dalam

”Kumpulan Dana Peserta”, kemudian dikembangkan melalui investasi proyek

yang dibenarkan Islam. Keuntungan investasi yang diperoleh dimasukkan ke

dalam ”Kumpulan Dana Peserta”. Setelah dikurangi beban asuransi (klaim,

premi asuransi) dan masih terdapat kelebihan , maka kelebihan itu akan

dibagi menurut prinsip al-mudharabah. Keuntungan peserta akan

dikembalikan kepada peserta yang tidak mengalami musibah. Sedangkan

keuntungan perusahaan akan digunakan untuk pembiayaan operasional

perusahaan.

• Pegadaian Syariah

Akad

mudharabah diterapkan untuk nasabah yang menginginkan untuk

menggadaikan jaminannya guna menambah modal usaha (pembiayaan investasi

atau modal kerja). Dengan demikian rahin akan memberikan bagi hasil

berdasarkan keuntungan usaha yang diperoleh kepada murtahin sesuai

dengan kesepakatan sampai dengan modal yang dipinjam terlunasi.

• BMT

Dalam

BMT aplikasi mudharabah tidak jauh berbeda dengan aplikasi mudharabah

pada perbankan syariah. Hal ini berkaitan dengan penyaluran dana BMT

kepada nasabah yang terdiri dari dua jenis, yaitu: pertama, pembiayaan

dengan sistem bagi hasil ; kedua, jual beli dengan pembayaran

ditangguhkan. Pembiayaan ini merupakan penyaluran dana BMT kepada pihak

ketiga, berdasarkan kesepakatan pembiayaan antara BMT dengan pihak lain

dengan jangka waktu tertentu dan nisbah bagi hasil yang disepakati, hal

ini tercermin dari aplikasinya mudharabah sebagai salah satu bentuk

penyaluran dana BMT tersebut.

K. Pembatalan Mudharabah

Akad mudharabah menjadi batal apabila ada perkara-perkara sebagai berikut:

1. Tidak

terpenuhinya salah satu atau beberapa syarat Mudharabah . Jika salah

satu syarat mudharabah tidak terpenuhi , sedangkan modal sudah dipegang

oleh pengelola dan sudah diperdagangkan, maka pengelola mendapatkan

sebagian keuntungannya sebagai upah, karena tindakannya atas izin

pemilik modal dan ia melakukan tugas berhak menerima upah. Jika terdapat

keuntungan, maka keuntungan tersebut untuk pemilik modal. Jika ada

kerugian, kerugian tersebut menjadi tanggung jawab pemilik modal karena

pengelola adalah sebagai buruh yang hanya berhak menerima upah dan tidak

bertanggung jawab sesuatu apa pun, kecuali atas kelalaiannya.

2. Pengelola

dengan sengaja meninggalkan tugasnya sebagai pengelola modal atau

pengelola modal berbuat sesuatu yang bertentangan dengan tujuan akad.

Dalam keadaan seperti ini pengelola modal bertanggng jawab jika terjadi

kerugian karena dialah penyebab kerugian.

3. Apabila pelaksana atau pemilik modal meninggal dunia atau salah seorang pemilik modal meninggal dunia, mudharabah menjadi batal.

Secara Harfiah

Al-muzara’ah (المزرعة) yang berarti tharh al-zur’ah (melemparkan tanaman), maksudnya adalah modal (al-hadzar)

Secara Istilah

1. Menurut

Hanafiyah, muzara’ah (مزرعة) ialah akad untuk bercocok tanam dengan

sebagian yang keluar dari bumi. Sedangkan mukhabarah (مخبررة) menurut

Syafi’iyah ialah : Akad untuk bercocok tanam dengan sebagian apa-apa

yang keluar dari bumi.

2. Menurut

dhahir nash, al-Syafi’i berpendapat bahwa mukhabarah (مخبررة) ialah

menggarap tanah dengan apa yang dikeluarkan dari tanah tersebut.

Sedangkan muzara’ah (مزرعة) ialah seorang pekerja menyewa tanah dengan

apa yang dihasilkan dari tanah tersebut.

3. Syaikh

Ibrahim al-Bajuri berpendapat bahwa mukhabarah (مخبررة) ialah

sesungguhnya pemilik hanya menyerahkan tanah kepada pekerja dan modal

dari pengelola. Dan muzara’ah (مزرعة) ialah pekerja mengelola tanah

dengan sebagian apa yang dihasilkan darinya dan modal dari pemilik

tanah.

Landasan Syariah

Hadist yang diriwayatkan oleh Bukhari dan Muslim dari Ibnu Abbas r.a :

”Sesungguhnya

Nabi SAW menyatakan, tidak mengharamkan bermuzara’ah, bahkan beliau

menyuruhnya, supaya yang sebagian menyayangi sebagian yang lain, dengan

katanya, barang siapa yang memiliki tanah, maka hendaklah ditanaminya

atau diberikan faedahnya kepada saudaranya, jika ia tidak mau, maka

boleh ditahan saja tanah itu”.

Diriwayatkan oleh Abu Dawud dan al-Nasa’i dari Rafi’ r.a dari Nabi SAW, beliau bersabda :

”Yang

boleh bercocok tanam hanya tiga macam orang : laki-laki yang ada tanah,

maka dialah yang berhak menanamnya dan laki-laki yang diserahi manfaat

tanah, maka dialah yang menanaminya dan laki-laki yang menyewa tanah

dengan mas atau perak”.

Menurut

al-Syafi’iyah , haram hukumnya melakukan muzara’ah (مزرعة). Ia

beralasan dengan hadist yang diriwayatkan oleh muslim dari Tsabut Ibn

al-Dhahak :

”Bahwa

Rasulullah SAW telah melarang bermuzara’ah dan memerintahkan sewa –

menyewa saja dan Rasulullah SAW bersabda, itu tidak mengapa”.

Menurut

pengarang kitab al-Minhaj , bahwa mukhabarah (مخبررة) , yaitu

mengerjakan tanah (menggarap ladang atau sawah) dengan mengambil

sebagian dari hasilnya, sedangkan benihnya dari pekerja dan tidak boleh

pula bermuzara’ah yaitu pengelolaan tanah yang benihnya dari pengolahan

tanah. Pendapat ini beralasan kepada beberapa hadist shahih, antara lain

hadist Tsabit Ibn Dhahak, karena mengingat akibat buruk sering terjadi

ketika berbuah.( Suhendi : 2002).

Rukun dan Syarat

Rukun : Ijab dan Qabul

Syarat:

1. Syarat yang bertalian dengan ’aqidain , yaitu harus berakal.

2. Syarat yang berkaitan dengan tanaman, yaitu disyaratkan adanya penentuan macam apa saja yang akan ditanam.

3. Hal yang berkaitan dengan perolehan hasil dari tanaman, yaitu :

a. Bagian masing-masing harus disebutkan jumlahnya (persentasenya) ketika akad

b Hasil adalah milik bersama

c.

Bagian antara Amil dan Malik adalah dari satu jenis barang yang sama,

misalnya dari kapas, bila Malik bagiannya padi kemudian Amil bagiannya

singkong, maka hal ini tidak sah.

d. Bagian kedua belah pihak sudah dapat diketahui

e.Tidak disyaratkan bagi salah satunya penambahan yang ma’lum.

4. Hal yang berhubungan dengan tanah yang akan ditanami , yaitu :

a.tanah tersebut dapat ditanami.

b.tanah tersebut dapat diketahui batas-batasnya.

5. Hal yang berkaitan dengan waktu, syarat-syaratnya ialah :

a.waktunya telah ditentukan

b.waktu

itu memungkinkan untuk menanam tanaman dimaksud, seperti menanam padi

waktunya kurang lebih 4 bulan (tergantung teknologi yang dipakainya,

termasuk kebiasaan setempat).

c.waktu tersebut memungkinkan dua belah pihak hidup menurut kebiasaan.

6. Hal

yang berkaitan dengan alat-alat muzara’ah , alat-alat tersebut

disyaratkan berupa hewan atau yang lainnya dibebankan kepada pemilik

tanah.

Hikmah Muzara’ah (مزرعة) dan Mukhabarah (مخبررة)

Muzara’ah

dan Mukhabarah (مخبررة) disyari’atkan untuk menghindari adanya

pemilikan hewan ternak yang kurang bisa dimanfaatkan karena tidak ada

tanah untuk diolah dan menghindari tanah yang juga dibiarkan tidak

diproduksikan karena tidak ada yang mengolahnya.

Muzara’ah

(مزرعة) dan mukhabarah (مخبررة) terdapat pembagian hasil. Untuk

hal-hal lainnya yang bersifat teknis disesuaikan dengan syirkah yaitu

konsep bekerja sama dalam upaya menyatukan potensi yang ada pada

masing-masing pihak dengan tujuan bisa saling menguntungkan.

MUSAQAH (مسقة)

Menurut Bahasa

Musaqah (مسقة) berasal dari kata al-saqa (السق)

Seseorang

bekerja pada pohon tamar, anggur (mengurusnya) atau pohon-pohon yang

lainnya supaya mendatangkan kemaslahatan dan mendapatkan bagian tertentu

dari hasil yang diurus sebagai imbalan.

Menurut istilah

Menurut

Syaikh Syihab al-Din al-Qalyubi dan Syaikh Umairah, al-musaqah (المسقة)

ialah Mempekerjakan manusia untuk mengurus pohon dengan menyiram dan

memeliharanya dan hasil yang dirizkikan Allah dari pohon itu untuk

berdua.

Landasan Syariah

Diriwayatkan Imam Muslim dari Ibnu Amr RA, bahwa Rasulullah SAW bersabda yang artinya :

”Memberikan

tanah Khaibar dengan bagian separoh dari penghasilan baik buah-buahan

maupun pertanian (tanaman). Pada riwayat lain dinyatakan bahwa Rasul

menyerahkan tanah Khaibar itu kepada Yahudi, untuk diolah dan modal dari

hartanya, penghasilan separohnya untuk Nabi”.

Rukun dan Syarat

Rukun: Ijab dan Qabul

Syarat:

1. Shigat,

yang dilakukan kadang-kadang dengan jelas (Sharih) dan dengan samaran

(kinayah), disyaratkan shighat dengan lafazh dan tidak cukup dengan

perbuatan saja.

2. Dua

orang atau pihak yang berakad (al-‘aqidani), disyaratkan bagi

orang-orang yang berakad dengan ahli (mampu) untuk mengelola akad,

seperti baligh, berakal dan tidak berada dibawah pengampunan.

3. Kebun

dan semua pohon yang berbuah, semua pohon yang berbuah boleh diparohkan

(bagi hasil), baik yang berbuah tahunan (satu kali dalam setahun)

maupun yang buahnya hanya satu kali kemudian mati seperti padi, jagung

dan yang lainnya.

4. Masa

kerja, hendaklah ditentukan lama waktu yang akan dikerjakan, seperti

satu tahun atau sekurang-kurangnya menurut kebiasaan dalam waktu

tersebut tanaman atau pohon yang diurus sudah berbuah, juga yang harus

ditentukan ialah pekerjaan yang harus dilakukan oleh tukang kebun,

seperti menyiram, memetongi cabang-cabang pohon yang akan menghambat

kesuburan buah atau mengawinkannya.

5. Buah,

hendaklah ditentukan bagian masing-masing (yang punya kebun dan bekerja

di kebun), seperti seperdua, sepertiga, seperempat atau ukuran yang

lainnya.

Daftar Pustaka:

Al-Qur’an dan Terjemahnya.

Agustianto. Slide Matakuliah Fiqih Muamalah. PSTTI-UI: 2008

www.mui.or.id

Demikianlah

itu tadi artikel mengenai Pengertian, Investasi, Deposito tentang Akad

Mudhorobah. Semoga artikel tersebut bermanfaat dan berguna untuk

teman-teman semuanya.

TRANSLATE IN ENGLISH LANGUAGE

Islamic

Banking | Tonight admin will provide information about the Sample

Scientific article / paper on Understanding , Scheme , Example , and the

Basic Law Mudharabah ( Mudhorobah ) . Hopefully this article , can be

useful to all my friends in order to complete the tasks assigned by the

teacher or lecturer .

MUDHARABAH

A. Definition

The word is derived from the word dharb mudaraba ( ضرب ) which means hitting or running . Definition of hit or run someone 's intention is to strike their feet in the process of running a business . A so-called mudaraba contract , because the workers ( mudharib ) usually requires a trip to run a business . While traveling in Arabic is called dharb fil Ardhi ( في الأرض ضرب ) .

In the language of Iraq ( Iraqi population ) named mudaraba , while the population of the Hijaz call Qiradh . Qiradh derived from the word al - qardhu , which means al - qath'u ( pieces ) because the owner cut off part of his property to be traded and retain a portion of its profits .

Mudaraba or Qiradh included in the category shirkah . In the Quran, the word mudaraba vaguer the term mudaraba . The Quran only mentions of the word is musytaq dharaba contained as many as 58 times . Some scholars give a sense of mudaraba or Qiradh as follows :

a) According to the jurists , mudaraba contract is between two parties ( people ) bear to each other , one party handed over his property to another party to trade with a predetermined portion of the profits , such as a half or a third of the conditions that have been determined .

b ) According to Hanafiyah , mudaraba is " Akad shirkah in profit , one -party property owners and other parties holding services " .

c ) Malikiyah found mudaraba is : " Akad representation , where the property owner issued his property to another for trade with the specified payment ( gold and silver ) " .

d ) Imam Hanabilah found Mudaraba is : " Like a property owner hands the possessions of a certain size to those who trade with part of the profits that are known " .

e ) Cleric Syafi'iyah found Mudaraba is : " Akad which determines a person's hands the fortune to others for ditijarahkan " .

f ) Shaykh Shihab al - Din al - Qalyubi and Umairah found mudaraba is : " Someone handed to another treasure for ditijarhakan and profit together . "

g ) Al - Bakri, Ibn al - Arif Billah al - Sayyid Muhammad Syata found Mudaraba is : " Someone gave the problem to another and in dalmnya acceptable replacement . "

h ) Sabiq Sayyid argues , Mudaraba is " contract between two parties for one party to spend some money for trading on the condition that profits halved in accordance with the agreement " .

i ) According to Imam Taqi al-Din , mudaraba is " financial Akad done for managed trade . "

From some of the above can be concluded that mudaraba is a business cooperation contract between two parties in which the first party is the owner of capital ( shahibul maal ) , while others become manager of capital ( mudharib ) , with the proviso that the results of the benefits will be shared for both parties in accordance with the collective agreement ( agreed ratio ) , but if there is a loss would be borne shahibul Maal .

scheme Mudaraba

100 % capital

Capital + Profit Sharing

B. Legal Basis

• Evidence Quran

" Your Lord knows that you stand ( prayer ) is less than two- thirds of the night , or half the night , or a third and ( so are ) a party of those with you . and God set the size of night and day . He knows that you can never determine the boundaries of those times , then he gives relief to you , because it's easy to read what ( you ) from the Koran . He knows that there will be those among you who are sick and those who walk on the land, seeking of Allah's bounty; and other people again fighting in Allah , then read what is easy ( for you ) from the Quran and establish worship , pay the poor- due, and give a loan to Allah a good loan . and whatever good you do for yourself surely you gain ( return) it Reply with Allah as the best and the greatest reward . and ask forgiveness of Allah ; Allah is Forgiving , Merciful " . ( Al - Muzzammil [ 73 ] : 20 )

The word became wajhud - dilalah or argument of the above paragraph is yadhribun same root word meaning mudaraba doing a business trip .

" There is no sin for you to seek the gifts ( sustenance result of commerce ) from your Lord . When ye have departed from ' Arafat ( completed wuquf ) , berdzikirlah to God in Masy'aril Haram and berdzikirlah ( with call ) Allah as shown unto him ; and Thou before it actually includes those who go astray " . [ Al - Baqarah ( 2 ) : 198 ]

• Evidence Hadith

كان سيدنا العباس بن عبد المطلب إذا دفع المال مضاربة اشترط على صاحبه أن لا يسلك به بحرا , ولا ينزل به واديا , ولا يشتري به دابة ذات كبد رطبة , فإن فعل ذلك ضمن , فبلغ شرطه رسول الله صلى الله عليه وآله وسلم فأجازه ( رواه الطبراني فى الأوسط عن ابن عباس ) .

" Abbas bin Abdul Muttalib is , when he handed over a number of assets in the investment mudaraba , so he made a condition to the mudharib , so that the treasure was not carried through the ocean , not down the valley and do not buy the animal , if the syarat2 mudharib violated , then it is responsible bear the risk . The terms of the proposed Abbas came to the Prophet and Apostle justify it " . ( HR ath_Thabrani ) . This hadith explains the practice of mudaraba muqayyadah .

ثلاثة فيهن البركة : المقارضة والبيع الى اجل وخلط البر باالشعير للبيت لا للبيع ( ابن ماجه )

" Three kinds of blessings received : muqaradhah / mudaraba , buying and selling is tough , with a mix of wheat flour for domestic use is not for sale " . ( HR.Ibnu Majah ) .

عن عبد الله و عبيد الله ابني عمر أنهما لقيا أبو موسى ألأشعري باالبصرة منصرفهما من غزوة نهاوند فتسلفا منه مالا وابتاعا منه متاعا و قدما به المدينة فباعاه و ربحا فيه و أراد عمر أخذ رأس المال الربح كله فقالا لو كان تلف كان ضمنه علينا فكيف لا يكون الربح لنا فقال رجل يا أمير المؤمنين لو جعلته قراضا فقال قد جعلته قراضا وأخذ منهما نصف الربح ( أخرجه مالك )

From Abdullah and ' Ubaidullah , both children Umar , that the two met with Abu Musa Al - Asy'ary in Basra , after coming home from the war Nahawand . Both received the treasure of Abu Musa to be taken to the Medina ( the capital city ) . In his second trip to buy jewelry property , then sell it at Medina , so that both benefit . Umar decided to take advantage of capital and everything . But his two children said , " If the treasure is destroyed , we are not responsible for replacing it . How is it that there is no advantage to us ? " . Then someone said to Umar , "O Commander of the Faithful , it would be nice if you make it as Qiradh treasure " . Omar then accept the proposal . Umar said , " I'm making Qiradh " . Umar took half of the profits ( 50 % for Baitul Mal and 50 % for two children ) .

Mudaraba according to Ibn Hajar has existed since the time of the Prophet , he knew and admitted it. Even before being appointed to the Prophet, Muhammad has done Qiradh / mudaraba . Muhammad traveled to Sham to sell goods belonging to Khadijah ra who later became his wife .

In addition to the arguments of the Qur'an and Hadith 'argument above , the scholars also based on mudaraba practices conducted some friends , while the other friend does not deny it . Even treasure mudaraba done it in the time they treasure most are orphans . Therefore, based on the arguments of the Qur'an , the Hadith , and the practice of the Companions , the scholars of jurisprudence establishes that mudharabah if it fulfills the conditions pillars and then the law is allowed .

C. Pillars and Conditions

Pillars and mudaraba legitimate requirements are as follows :

1 . Presence of two or more actors , ie the investor ( capital owners ) and managers ( mudharib ) . Both sides were able to perform the required contract or qualified tasharruf law , then canceled the contract of children are still small , the insane , and the people who are under guardianship .

2 . Capital or principal assets ( mall ) , the terms are:

A. Form of money

The majority of scholars argue that the capital should be in the form of money and goods should not . Mudaraba with goods can lead to ambiguity , because the goods are generally volatile. If the goods are not volatile as gold or silver bullion form ( tabar ) , the scholars differed . Imam Malik in this case does not expressly prohibit or allow . But the scholars of the Hanafi school allows it and the value of capital goods to be used as payment when the contract is agreed upon by mudharib and Shahibul mall .

For example , a car has to be submitted to mudharib ( manager of capital ) . When the partnership agreement agreed , then mobal shall be determined at the time of the currency , for example Rp90.000.000 , then the mudaraba capital is Rp90.000.000 .

Obviously the number and type B.

Total capital must be known in order to distinguish clearly between the traded capital gain or profit from the trade that will be distributed to the two sides in accordance with the agreements that have been agreed upon .

C. Cash

Debt can not be used as mudaraba capital . Without capital injection , mean Shahibul mall does not contribute anything when mudarib has worked . The Shafi'i and Maliki scholars prohibit it because undermine the legitimacy of the contract . In addition, it could open the door usury act , which gives respite to the debt that has been unable to pay its debts with the compensation berpiutang obtain certain rewards . In this case the scholars of fiqh not disagree.

D. Capital left entirely to the manager directly

If not submitted to mudharib directly and not left entirely ( gradually ) feared would be damage to the capital , which can be annoying delay time due to work and further reduce its fullest . When the capital was partially retained by the owners of capital , in the sense of not left entirely , then according to scholars Hanafiyah , Malikiyah , and Syafi'iyah , mudharabah invalid . While scholars may be partly Hanabilah stated capital is in the hands of capital owners , the origin does not interfere with the smooth running of their business.

3 . Gain , the terms are:

A. Proportion clear . Gains will be owned by the management and owners of capital should be clear percentage , such as 60 % : 40 % , 50 % : 50 % and so on according to the collective agreement .

B. Profits must be shared for both sides , ie the investor ( capital owners ) and managers ( mudharib ) .

C. Break Even Point ( BEP ) should be obvious , since the BEP using revenue sharing system with different profit sharing . Profit sharing revenue sharing is done before the cut operating costs , so that the calculated results of the gross profit / revenues . While profit sharing profit sharing is done after the cut operating costs , so the result is calculated from net profit .

4 . Consent qobul . Melafazkan consent of the owners of capital , for example, I leave you this money to trade if there is a profit to be halved and granted from the manager .

D. Lessons and Distribution Mudaraba

Judging from the transaction (contract ) by the mall and mudharib Shahibul , mudaraba is divided into :

a) Mudaraba Muqayyadah (Restricted Investment Account ) , which is a form of cooperation between the requirements and certain restrictions . Where Shahibul mall restrict the type of business , time or place of business . In terms of modern Islamic economics , mudaraba type is called the Restricted Investment Account . These limits are intended to save the capital from risk of loss . The requirements that must be met by the mudharib . If mudharib violate these limits , then he should be responsible for losses incurred .

Restrictions on the type of mudaraba disputed the scholars regarding its validity . But rajih , such restrictions are useful and not at all the arguments menyelisihi Sharai , because just based on ijtihad and the deal is done and the pleasure of both parties , so shall fulfilled . How mudharabah muqayyadah recording are of two kinds , namely :

a. Off Balance Sheet , its provisions are:

1 . Shariah Bank acted as arranger and got only as an arranger fee

2 . Recording transactions in shariah bank off balance sheet

3 . Those involving only the result of investors and debtors customers only

4 . The Great sharing according to the agreement investor customers and debtors

b . On Balance Sheet , its provisions are:

1 . Customers Investors mensyarakatkan financing target funds , such as for certain agricultural , property , or mining only

2 . Mutilations in Shariah banks are on balance sheet

3 . Determination of the profit sharing ratio over the bank and the customer agreement

b ) Mudaraba Muthlaqah ( Unrestricted Investment account ) , which is a form of cooperation between the mall and mudharib Shahibul unconditionally or without being limited by the specification of the type of effort , time , and area businesses . In English , the Islamic economists often refer to as the mudaraba muthlaqah Unrestricted Investment Account ( Uriah ) . So if there is a loss in the business , mudharib not bear the risk for any losses . Losses are fully addressed Shahibul mall .

c ) Mudaraba musytarakah , is a form of mudaraba which includes fund manager or fund capital investment cooperation .

E. DSN

• National Fatwa Council No. Shariah . 07/DSN-MUI / IV / 2000 on Mudaraba ( Qiradh )

Terms of Financing :

1 ) Mudaraba financing is financing provided by BLM to another party for a productive business .

2 ) In this financing LKS as Shahibul Maal ( lenders ) to finance 100 % of the project ( business ) , while the employer ( client ) to act as mudharib or business manager .

3 ) Duration of business , refund procedures , and profit sharing is determined by agreement of both parties ( LKS with employers ) .

4 ) Mudharib may perform a variety of efforts that have been mutually agreed and in accordance with the Shari'ah ; and LKS did not participate in the management company or the project , but has the right to conduct training and supervision .

5 ) amount of funding should be clearly stated in the form of cash and not debt .

6 ) LKS as fund providers bear all losses resulting from the mudaraba unless mudharib ( customers ) make mistakes intentional , negligent , or violate the agreement .

7 ) In principle , the financing is there is no guarantee , however, in order not to deviate mudharib , LKS may request assurance from mudharib or third parties . This guarantee can only be availed if mudharib proved a foul on the things that have been agreed in the contract .

8 ) Criteria entrepreneurs , financing procedures , and benefit sharing mechanisms regulated by the BLM with regard fatwa DSN .

9 ) Operating costs charged to mudharib .

10 ) In terms of funding ( LKS ) undertakes no obligation or violation of the agreement , mudharib entitled to damages or costs incurred .

Second : Pillars and Terms of Financing :

1 . Providers of funds ( sahibul maal ) and manager ( mudharib ) must be capable of law .

2 . Statement qabul consent and must be declared by the parties to indicate their desire to enter into contracts (contract ) , with regard to the following :

a. Offer and acceptance must explicitly indicate the purpose of the contract (contract ) .

b . Acceptance of the offer made at the time the contract .

c . The written contract , by correspondence , or by using modern means of communication .

3 . Equity is the amount of money and / or assets of the funds provided by the provider to mudharib for business purposes with the following requirements :

a. Capital must be known quantity and type.

b . Capital can take the form of money or goods are assessed . If given in the form of capital asset , the asset must be assessed at the time of contract .

c . Capital accounts and the form can not be paid to mudharib , either incrementally or not , in accordance with the agreements in the contract .

4 . Advantages mudaraba is obtained as the excess amount of capital . Terms gains following must be met :

a. Should cater for both parties and should not be required for only one party .

b . Proportionate share of the profits for each party must be known and stated at the time the contract was agreed and should be in the form of percentage ( ratio ) of the profits as agreed . Changes must berdasarkankesepakatan ratio .

c . Fund providers bear all losses resulting from the mudaraba , and managers must not bear any loss unless resulting from accidental errors , omissions , or breach of the agreement .

5 . Activities by business managers ( mudharib ) , as equalization ( muqabil ) capital provided by the provider of funds , should pay attention to the following matters :

a. Business activities are exclusive rights mudharib , without the intervention fund provider , but he has the right to conduct surveillance .

b . Providers should not fund managers such narrow measures that may hinder the achievement of mudaraba , namely profits .

c . Business should not be violated Islamic Sharia law in its actions related to the mudaraba , and must comply with customs prevailing in the activity .

Some Provisions of Law Funding :

1 ) Mudaraba may be limited to a certain period .

2 ) The contract should not be linked ( mu'allaq ) with a future event that is not necessarily the case.

3 ) Basically , in a mudaraba no compensation , because basically it is a mandate agreement ( yad al - trust) , except as a result of accidental errors , omissions , or breach of the agreement .

4 ) If either party does not fulfill its obligations or in the event of a dispute between two parties , the settlement through Arbitration Board Shariah after no agreement was reached by consensus

• National Fatwa Council No. Sharia . 50 / DSN - MUI / III / 2006 on Mudharabah musytarakah

First : General Provisions

Musytarakah Mudaraba Mudaraba is a form of contract where the manager ( mudharib ) include capital or investment funds in cooperation .

Second : Legal Requirements

Mudaraba musytarakah allowed by Shariah Financial Institutions ( LKS ) , because it is part of the law of Mudaraba .

Third : Terms of Agreement

1 . Akad used is musytarakah Mudaraba contract , which is a combination of contract Mudaraba and Musharaka contract .

2 . Worksheets as mudharib include capital or investment funds in mutual customers .

3 . Worksheets as the party that put up the money ( musytarik ) receive the profits based on the portion of capital or included.

4 . Portion advantage taken by the BLM after a musytarik divided between LKS as mudharib with customer funds according to the agreed ratio .

5 . Event of the loss of LKS as musytarik bear the loss in proportion to the capital or funds are included .

Fourth : Final Provisions

1 . If either party does not fulfill its obligations or in the event of a dispute between the parties , the settlement through Arbitration Shariah after no agreement was reached by consensus .

2 . Fatwa is valid from the date of enactment , the provision in the future if it turns out there is a mistake , will be modified and refined as it should be .

F. Differences Interest and Profit Sharing

No Interest For Results

1 . Interest determination is made before

his ( at the time of contract ) without

based on the determination of the cost-benefit ratio for the results with the agreement made at the time based on the profit and loss

2 . Percentage amount ( interest )

predetermined based

right amount of money loaned amount is based on profit -sharing , in accordance with an agreed ratio

3 . Total interest payments do not increase even if the amount of profit sharing profit increased number increases with the increase in revenue

4 . The event of a loss , covered the

Borrowers only, based on devel

Yaran fixed interest promised the event of a loss incurred both sides

5 . Interest amount to be paid must be accepted bank borrower business success of common concern

6 . Generally Religion ( especially Islam ) No Doubt criticize Sharing System

7 . Contrast with Surah Luqman : 34 Implement Surah Luqman : 34

G. Application Mudaraba in Islamic Banking

Mudaraba is usually applied to financial products and financing . On the fund raising side , al - mudaraba applied to :

a) Savings deposits mudaraba is a third party in the penarikannnya Islamic Banking can be done any time of day or according to the agreement . In this case the Bank acts as Mudharib ( manager of capital ) and depositors as Shahibul Maal ( owners of capital ) . Bank as mudharib will divide the profits according to Shahibul Maal ratio ( percentage ) that has been agreed .

b ) Mudaraba Deposit ( Deposit Investment Mudaraba ) is a savings- investment of third parties ( individuals or legal entities ) , which penarikannnya only be done in a certain period of time ( maturity) to get rewarded for results .

The terms of the financing , mudaraba applied for :

a) Working capital financing . Banks provide financing capital investment or working capital fully ( capital owners / sahhibul maal ) , while providing customers and the business management ( mudharib ) Results profits will be divided in accordance with the collective agreement in the form of a ratio ( percentage ) of certain advantages for example 65 % : 35 % .

b ) Special Investments , also called mudaraba muqayyadah , where the source of a special fund with special disbursements by the terms set by Shahibul maal .

Mechanism and Operating Systems Mudaraba in Islamic Banking

Mudaraba Mudaraba Financing

Islamic Bank

Sharing Sharing

In the practice of Islamic banking , now there are two forms of mudaraba muqayyadah , namely :

a) On the balance sheet , the cash flow going from one customer executing a group of investors to venture in some limited sectors , such as agriculture , manufacturing and services . Other investor customers may require funds may only be used for financing in the mining sector , and agricultural properties . In addition by sector , investors may require the customer based on the type of contract used , for example just by the credit sale contract only. This scheme is called On Balance Sheet as recorded in the balance sheet .

b ) Off -balance sheet , the cash flow derived from a single customer to a client investor financing ( which in a conventional bank is called the debtor ) . Here the Islamic bank acts only as an arranger alone . Recording of transactions in Islamic banks carried off balance sheet . For only the results involving investor customers and implementing their business in accordance with the agreement , while only acquiring bank arranger fee.

H. Security ( Collateral )

I. Assurance mudaraba in fiqh litelatur

The relationship between the investor with mudharib is a relationship that is " pawn " and mudharib is the person who believed , then there is no guarantee by mudarib to investors . Investors can not claim any guarantee of mudharib to restore capital gains . If investors require guarantees of mudharib and expressed this in terms of the contract , then they mudaraba contract is not valid , according to Malik and Shafi'i .

2 . Assurance mudaraba in the Islamic banking

Based fatwa DSN - MUI concerning financing is ( Qiradh ) that in principle there are no guarantees in mudaraba . But in order not to deviate mudharib , Shariah Financial Institutions may request assurance from mudharib or third parties . This guarantee can only be availed if mudharib proven violating the things that have disepekati together in agreement . So the guarantee is only for show seriousness and prevent fraud mudharib do . Such statements quoted from the AAOIFI , the Accounting and Auditing Organization for Islamic Financial Institutions , Bahrain , 1998 that " collateral is important to protect the Islamic bank from any misconduct " .

J. Application Mudaraba in Islamic Financial Institutions

• Takaful

1 . Takaful family

Takaful premiums received put in " Savings Account " which is a savings account and the participant " Special Account ( Tabarru ' ) is a special account reserved for the good of a payment claim ( takaful benefit ) to the beneficiary if there among participants who died or suffered other calamity . Takaful premium is put together in a collection of fund participants , then developed through investment projects that Islam justified , by applying the principle of al - mudaraba in accordance with the agreement , for example 70 % profit for the participants and 30 % for the company . Of the participants 70 % gain was included in a special savings account and account proportionally . Meanwhile, corporate profits by 30 % is used to finance the company's operations .

- Actual payment account if:

• the coverage period ends

• resigned participants in the insurance period .

• Participant dies during the coverage period .

- While the payment account if:

• participants died during peratanggungan

• coverage period expires ( if any ) .

2 . General Takaful

Takaful premiums received is inserted into a special account ( tabarru ' ) account that is exclusively reserved for the goodness in the form of claim payments to participants at any time if stricken by either the property or the participants themselves . Takaful premiums are included in the " Collection Fund Participants " , then developed through investment projects that Islam justified . The advantage gained investment put into the " Collection Fund Participants " . After expenses insurance ( claims , insurance premiums ) and still there is excess , then the excess will be divided according to the principle of al - mudaraba . Advantage participants will be returned to participants who did not experience a disaster . Meanwhile, corporate profits will be used to finance the company's operations .

• Pawn Sharia

Mudharabah applied to customers who want to pawn collateral in order to increase venture capital ( investment or working capital financing ) . Thus rahin will provide the results based on business profits earned in accordance with the agreement to murtahin up with borrowed capital repaid .

• BMT

In the BMT application is not much different mudaraba mudaraba application on Islamic banking . This relates to the distribution of funds to customers BMT consisting of two kinds , namely : first , the financing system for the results ; second , the sale and purchase with deferred payment . This financing is channeling funds to a third party BMT , based on the financing agreement between BMT and other parties with a specific period and agreed profit sharing ratio , which is reflected on the application mudaraba as one form of the distribution of funds BMT .

K. Cancellation Mudaraba

Mudharabah be canceled if there are matters as follows :

1 . Non-fulfillment of one or more terms Mudaraba . If either condition is not met mudaraba , while capital already held by the management and has been traded , then managing to get some of the profits as wages , because the permission of the owner of capital actions and he did have a reward task . If there is a profit , then the profit for the owners of capital . If there is a loss , the loss is the responsibility of the owners of capital as a manager is only entitled to receive workers' wages and are not responsible for anything whatsoever , except upon negligence .

2 . Business deliberately left his job as manager of capital or capital managers to do something that is contrary to the purpose of the contract . In these circumstances bertanggng capital manager responsible for any loss because he was the cause of loss .

3 . If the executor or capital owner dies or one of the owners dies capital , mudaraba is void .

Muzara'ah AND MUKHABARAH

Literally

Al - muzara'ah ( المزرعة ) which means tharh al - zur'ah ( throwing plants ) , referring to the capital ( al - hadzar )

In terms

1 . According Hanafiyah , muzara'ah ( مزرعة ) contract is to grow crops with most coming out of the earth . While mukhabarah ( مخبررة ) by Syafi'iyah is : Agreement to farm with most anything that comes out of the earth .

2 . According dhahir texts , al - Shafi'i found mukhabarah ( مخبررة ) is working on the ground with what was released from the soil . While muzara'ah ( مزرعة ) is a worker lease land with what comes out of the ground .

3 . Shaykh Ibrahim al - Bajuri found mukhabarah ( مخبررة ) is the real owner of the land handed over only to the workers and the capital of the manager . And muzara'ah ( مزرعة ) is working to manage the land with most of what comes out of it and the capital of the land owner .

The foundation of Sharia

Hadith narrated by Bukhari and Muslim from Ibn `Abbas :

" Indeed, the Prophet declared , not proscribe bermuzara'ah , he even told him , that the most loving others , with he , he who owns the land , then let plants a boondoggle or given to his brother , if he refuses , then it may be detained the soil " .

Reported by Abu Dawud and al - Nasa'i from Rafi ' ra of the Prophet , he said:

" That may be fished only three kinds of people : men no land , then he is entitled to plant and men entrusted with the benefits of the land , then he is planted and the man who rented the land with gold or silver " .

According to al - Syafi'iyah , unlawful conduct muzara'ah ( مزرعة ) . He reasoned with the hadith narrated by Muslim from Ibn al - Dhahak Tsabut :

" That the Prophet Muhammad has forbidden bermuzara'ah and ordered rent - rent only and the Prophet SAW said , it does not matter " .

According to the author of the book al - Minhaj , that mukhabarah ( مخبررة ) , which is working on the ground ( work fields or fields) to take some of the results , while the seeds of workers and should not be too bermuzara'ah is the seed of the land management land treatment . This opinion is justified to some Saheeh hadith , among other hadith Ibn Thabit Dhahak , because considering the bad consequences often occur when fruiting . ( Suhendi : 2002) .

Pillars and Conditions

Pillars : Ijab and qabul

Terms :

1 . Terms related to the ' aqidain , which must be rational .

2 . Terms relating to plants , which required the presence of any kind of determination that will be planted .

3 . Matters related to the acquisition of the results of the plant , namely :

a. Each part must mention the amount ( percentage ) when the contract

b Results are common property

c . Section between Amil and Malik are of the same type of item , such as cotton , rice parts when Malik then Amil cassava parts , then it is not valid .

d . Part two sides already be known

e.Tidak required for the addition of one ma'lum .

4 . Thing relating to the land to be planted , namely :

a.tanah can be planted .

The b.tanah can know its limits .

5 . Thing relating to time , the terms are :

a.waktunya been determined

b.waktu it is possible to grow crops , such as rice planting time is less than 4 months ( depending on the technology employed, including local customs ) .

c.waktu allows two parties to live according to the customs .

6 . Thing relating to muzara'ah tools , the tools required in the form of animals or other things charged to the landowner .

Wisdom muzara'ah ( مزرعة ) and Mukhabarah ( مخبررة )

Muzara'ah and Mukhabarah ( مخبررة ) disyari'atkan to avoid the lack of ownership of livestock can be used because there is no land to cultivate, and avoid soil also produced left because no process .

Muzara'ah ( مزرعة ) and mukhabarah ( مخبررة ) are sharing the results . For other matters of a technical nature that is adapted to shirkah concept of working together in an effort to unite the potential of each party with a purpose can be mutually beneficial .

MUSAQAH ( مسقة )

According to Language

Musaqah ( مسقة ) is derived from the word al - Saqa ( السق )

Someone working on tamar trees , grapes ( take care ) or other trees in order to bring benefit and get a certain portion of the proceeds are taken care of in return .

According to the terms

According to Shaykh Shihab al - Din al - Shaykh Qalyubi and Umairah , al - musaqah ( المسقة ) is Hiring people to take care of the tree and keep it watered and God dirizkikan results from the tree for both .

The foundation of Sharia

Imam Muslim narrated from Ibn ' Amr RA that the Prophet SAW said , which means :

" Giving the land of Khaibar to the half part of the income either fruits or agricultural ( crop ) . In another narration it is stated that the Apostles handed over the land of Khaibar to the Jews , to be processed and the capital of his property , income separohnya to the Prophet " .

Pillars and Conditions

Pillars : Ijab and qabul

Terms :

1 . Shigat , who performed occasionally with clear ( sharih ) and with a pseudonym ( kinayah ) , required shighat with wording and not enough to act alone .

2 . Two persons or parties berakad ( al - ' aqidani ) , required for people who berakad with experts ( able ) to manage the contract , such as baligh , intelligent and not under remission .

3 . Gardens and all the fruit trees , all trees that bear fruit may diparohkan (profit sharing ) , both of which bear annual ( once per year ) and the fruit only once and then die like rice , maize and others .

4 . Period work , let the specified length of time to be done , such as one year or at least according to the custom of the time that is taken care of plants or trees have fruit , also to be determined is work to be done by the gardener , such as watering , memetongi tree branches that will inhibit fertility fruit or marry .

5 . Fruits , let each specified section ( which has a garden and working in the garden ) , such as half , a third , or a quarter of the size of the other .

Bibliography :

Al - Quran and Terjemahnya .

Agustianto . Tenets Fiqh Course slides . PSTTI - UI : 2008

www.mui.or.id

So it was an article about Understanding , Investments, Deposits on Mudhorobah Akad . Hopefully this article useful and handy for all my friends .

MUDHARABAH

A. Definition

The word is derived from the word dharb mudaraba ( ضرب ) which means hitting or running . Definition of hit or run someone 's intention is to strike their feet in the process of running a business . A so-called mudaraba contract , because the workers ( mudharib ) usually requires a trip to run a business . While traveling in Arabic is called dharb fil Ardhi ( في الأرض ضرب ) .

In the language of Iraq ( Iraqi population ) named mudaraba , while the population of the Hijaz call Qiradh . Qiradh derived from the word al - qardhu , which means al - qath'u ( pieces ) because the owner cut off part of his property to be traded and retain a portion of its profits .

Mudaraba or Qiradh included in the category shirkah . In the Quran, the word mudaraba vaguer the term mudaraba . The Quran only mentions of the word is musytaq dharaba contained as many as 58 times . Some scholars give a sense of mudaraba or Qiradh as follows :

a) According to the jurists , mudaraba contract is between two parties ( people ) bear to each other , one party handed over his property to another party to trade with a predetermined portion of the profits , such as a half or a third of the conditions that have been determined .

b ) According to Hanafiyah , mudaraba is " Akad shirkah in profit , one -party property owners and other parties holding services " .

c ) Malikiyah found mudaraba is : " Akad representation , where the property owner issued his property to another for trade with the specified payment ( gold and silver ) " .

d ) Imam Hanabilah found Mudaraba is : " Like a property owner hands the possessions of a certain size to those who trade with part of the profits that are known " .

e ) Cleric Syafi'iyah found Mudaraba is : " Akad which determines a person's hands the fortune to others for ditijarahkan " .

f ) Shaykh Shihab al - Din al - Qalyubi and Umairah found mudaraba is : " Someone handed to another treasure for ditijarhakan and profit together . "

g ) Al - Bakri, Ibn al - Arif Billah al - Sayyid Muhammad Syata found Mudaraba is : " Someone gave the problem to another and in dalmnya acceptable replacement . "

h ) Sabiq Sayyid argues , Mudaraba is " contract between two parties for one party to spend some money for trading on the condition that profits halved in accordance with the agreement " .

i ) According to Imam Taqi al-Din , mudaraba is " financial Akad done for managed trade . "

From some of the above can be concluded that mudaraba is a business cooperation contract between two parties in which the first party is the owner of capital ( shahibul maal ) , while others become manager of capital ( mudharib ) , with the proviso that the results of the benefits will be shared for both parties in accordance with the collective agreement ( agreed ratio ) , but if there is a loss would be borne shahibul Maal .

scheme Mudaraba

100 % capital

Capital + Profit Sharing

B. Legal Basis

• Evidence Quran

" Your Lord knows that you stand ( prayer ) is less than two- thirds of the night , or half the night , or a third and ( so are ) a party of those with you . and God set the size of night and day . He knows that you can never determine the boundaries of those times , then he gives relief to you , because it's easy to read what ( you ) from the Koran . He knows that there will be those among you who are sick and those who walk on the land, seeking of Allah's bounty; and other people again fighting in Allah , then read what is easy ( for you ) from the Quran and establish worship , pay the poor- due, and give a loan to Allah a good loan . and whatever good you do for yourself surely you gain ( return) it Reply with Allah as the best and the greatest reward . and ask forgiveness of Allah ; Allah is Forgiving , Merciful " . ( Al - Muzzammil [ 73 ] : 20 )

The word became wajhud - dilalah or argument of the above paragraph is yadhribun same root word meaning mudaraba doing a business trip .

" There is no sin for you to seek the gifts ( sustenance result of commerce ) from your Lord . When ye have departed from ' Arafat ( completed wuquf ) , berdzikirlah to God in Masy'aril Haram and berdzikirlah ( with call ) Allah as shown unto him ; and Thou before it actually includes those who go astray " . [ Al - Baqarah ( 2 ) : 198 ]

• Evidence Hadith

كان سيدنا العباس بن عبد المطلب إذا دفع المال مضاربة اشترط على صاحبه أن لا يسلك به بحرا , ولا ينزل به واديا , ولا يشتري به دابة ذات كبد رطبة , فإن فعل ذلك ضمن , فبلغ شرطه رسول الله صلى الله عليه وآله وسلم فأجازه ( رواه الطبراني فى الأوسط عن ابن عباس ) .